Annual Report 2023

Defining

Success

Last year proved to be a challenging year for the insurance industry. I am proud of our response to those challenges and steadfast in my belief that Central has never been better positioned to fulfill our promise to policyholders.

Our personal lines business in 2023 was significantly challenged by unprecedented reinsurance cost increases, record-breaking catastrophic losses, and persistent inflationary pressures. With incredible fortitude, Central responded by leveraging its financial strength, solid commercial lines performance, and world-class service.

We invested in products and solutions that deliver the exceptional hospitality our agents and policyholders have come to expect. We excelled at customer service and claims handling. We grew our Policyholder’s Surplus. We doubled down on our people, modernized our technology, and strengthened our communities. These accomplishments reflect our collective commitment to excellence as we continue to build for the future.

For the past 147 years, Central has proudly fulfilled its promises to agents, policyholders, employees, and the community. In 2023, we honored those commitments while navigating a challenging year with resilience and stability. That’s a success story I’m proud to share.

Evan Purmort

Chairman, CEO, President

Resilience and Stability

While the economic volatility and catastrophic weather of 2023 adversely impacted the insurance industry, Central stood resilient and strategically positioned itself for future success.

97.6%

Combined Ratio for the

Commercial Lines Accident Year

115.0%

Combined Ratio for the

Personal Lines Accident Year

$127M

Exceeded Our New Business Goal

We wrote more new business than we've ever written in a year.

1.59%

Return on Surplus

Our return on surplus reflects our steadfast commitment to effective capital utilization and sustained profitability.

Jessica Seymour

Chief Financial Officer

Jocelyn Pfeifer

Chief Insurance Officer

Chad Glenn

Chief Distribution Officer

Aligning Our Expertise

We're investing in our future by growing a leadership team dedicated to enhancing underwriting and product specialization. Last October, Central made three significant promotions to support these goals. Jessica Seymour was promoted to Chief Financial Officer, Jocelyn Pfeifer to the new role of Chief Insurance Officer, and Chad Glenn to the new role of Chief Distribution Officer. The CDO position better aligns marketing and distribution, while the CIO role naturally aligns product, underwriting, and pricing. Our CFO oversees smart capital allocation on both the underwriting and investment side. These promotions connect the right people to the right growth opportunities, and their expertise will continue driving higher revenues, better products, and stronger relationships.

Building for Today, Adding Value for Years to Come

As a product-led organization, understanding our customers' daily responsibilities, concerns, and expectations drives Central's product development. Our internal product, engineering, and tech teams worked closely throughout the year to research and design products aligned with agent and policyholder feedback. This approach supports innovation, collaboration, and efficiency across the company to lead a product from idea to adoption. The work they accomplished in 2023 will serve as a foundation for product deliverables and customer experience enhancements in the year ahead.

Growing Commercial Lines

Introducing Central's BOP

Now available in 22 states, Central's new Business Owner's Policy (BOP) makes it easy to find the right coverage for qualifying small businesses. The BOP’s property and liability coverages include Contractor’s Installation, Contractor’s Tools and Equipment, Cyber Suite, Equipment Breakdown, Employee Practices Liability, and more.

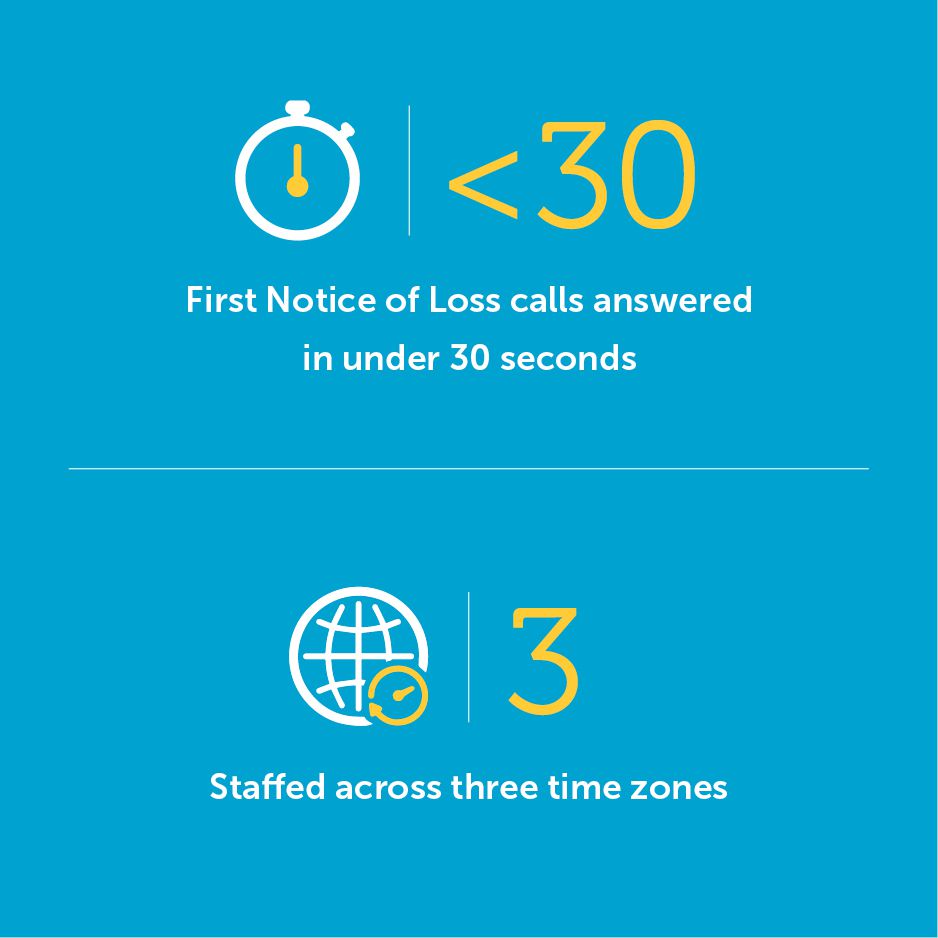

The Power of Connection

Client Connection embodies our commitment to providing a unique customer journey, seamlessly integrating with our agency partners to enhance the experience for our valued policyholders. Offering extended operational hours and personalized support from a dedicated point of contact, our Client Connection team remains devoted to enriching our agents' service capabilities and delivering unparalleled customer care.

Fulfilling Our Promise in

the Moments That Matter Most

Mission

To deliver exceptional hospitality, achieve optimal claim outcomes, and operate at maximum efficiency.

Vision

To become the most intelligent claims organization in the world.

Efficiency Meets Exceptional Hospitality

Integrating two-way texting into our claims system enhances the customer experience by offering a seamless and efficient communication channel between customers and claim specialists. Customers benefit from unparalleled convenience, allowing them to engage with Central at their own pace and in any environment. The immediacy of texting ensures swift responses, significantly reducing wait times, and the written documentation of all interactions ensures clarity and eliminates misunderstandings. This user-friendly approach streamlines the claims process, fostering customer trust and satisfaction.

6,900

Claims customers who utilized Central's text communication services.

2,700

Customers who expedited their claim by texting photos of damaged property.

85,730

Total text message communications received in 2023.

Hospitality in Action

Our policyholders turn to us during the most challenging and unexpected moments of their lives. Each day, we honor their trust by providing an exceptional claims experience defined by empathy, efficiency, and responsiveness.

Connected Through Our Culture

We strive to foster an internal culture where everyone understands their purpose, has a voice, and feels surrounded by talented people who genuinely care.

Investing in Our Communities

In partnership with our employees, we're working together to make a positive difference in the lives of our neighbors and the places we call home.

Van Wert Forward

Central is proud to support our community through a $17 million investment in Van Wert Forward. The redevelopment project is designed to attract new businesses, preserve local history, beautify downtown, and create affordable, accessible housing. Phase two of the project is currently underway.

Central Ohio Technology Office

Last year, Central unveiled plans to construct a new Central Ohio Technology Office. Located in Dublin's Bridge Park District, the space will serve as a hub for our technology, product development, and engineering teams, providing employees with a workspace designed to support greater innovation and collaboration. Construction of the COTO office was a collaborative effort in partnership with Nelson Worldwide, Crawford Hoying, Brackett Builders Inc., and Innovative Office Solutions Inc. Central's Columbus team officially moved into the new COTO space in April 2024.

United Way

Employees contributed $60,000 to the United Way in 2023, an amount Central matched for a total contribution of $120,000. This financial donation, along with food and blood donations and time volunteered for the Day of Caring, helped strengthen our community and embody Central's culture of hospitality.

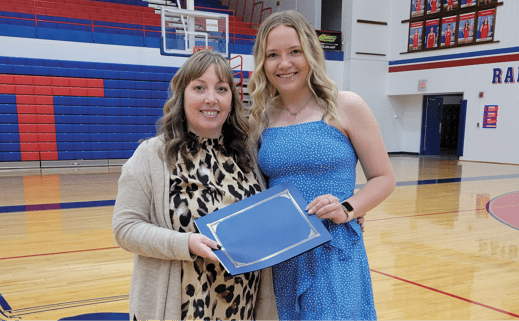

Scholarship Program

We're honored to support the local community through Central's Educational and Charitable Foundation Scholarship. We awarded five new scholarships and 13 renewal scholarships amounting to $90,000 for the 2023-2024 school year.

Community Boards

Over 100 Central employees serve on local civic, school, church, and non-profit boards and committees. Their commitment to fulfilling the promise extends beyond the workplace, demonstrating a genuine passion for making a positive impact in the lives of others.

Salvation Army Angel Tree

We're proud to support the Salvation Army in its efforts to brighten the holidays for those in need. Last year, Central employees raised $5,449 in donations, and with the company's match, we contributed $10,898 to the Angel Tree initiative. Thanks to the generosity of our employees—and a little help from 38 Central volunteer shoppers—we provided gifts to 75 children and four local families.

Financial Report

2023 Financial Report

Central Mutual and All America Insurance Companies ('Central')

December 31, 2023

Summarized Balance Sheet as of 12/31/2023

| Assets | |

|---|---|

| Bonds | $1,367,068,718 |

| Stocks | $388,062,284 |

| Other Invested Assets | $63,872,537 |

| Real Estate | $33,329,650 |

| Cash & Short-Term Investments | $59,829,452 |

| Agents' Balances & Uncollected Premiums | $297,789,082 |

| All Other Assets | $60,741,179 |

| Total Admitted Assets | $2,270,692,902 |

| Liabilities & Policyholders' Security Fund | |

|---|---|

| Losses & Loss Adjusting Expenses | $676,359,106 |

| Unearned Premiums | $449,509,366 |

| Commissions Payable & Contingent Commissions | $30,292,434 |

| Ceded Reinsurance Premiums Payable | $10,350,744 |

| Taxes & Other Liabilities | $59,166,023 |

| Unassigned Funds (Policyholders' Security Fund) | $1,045,015,229 |

| Total Liabilities & Policyholders' Security Fund | $2,270,692,902 |

| Select Performance Measures | |

|---|---|

| Total Central Assets | $2,270,692,902 |

| Written Premium* | $941,634,494 |

| Growth Rate in Written Premium* | 12.8% |

| Combined Ratio - Central | 106.4% |

| Policyholders' Security Fund | $1,045,015,229 |

| Net Written Premium to Policyholders' Security Fund Ratio | 0.82 |

| A.M. Best Rating | A (Excellent) |

* Includes Direct and Voluntary Assumed Premium