Evan Purmort

CEO & President

Letter from the President

Central began as a company rooted in fulfilling the promise. Over the years, we have never wavered on that commitment. How we fulfill that promise has evolved and grown alongside the changing needs of our agents and policyholders, but we’ve never lost sight of the integrity, relationships and excellence that serve as our North Star.

The past few years have taught us all a lot about what’s possible when we come together to do hard things. The choices we make today have an impact on what tomorrow will look like for everyone. 2020 was a year of asking questions and listening to our agents. 2021 was a year of action and innovation fueled by the insights we gained from those conversations.

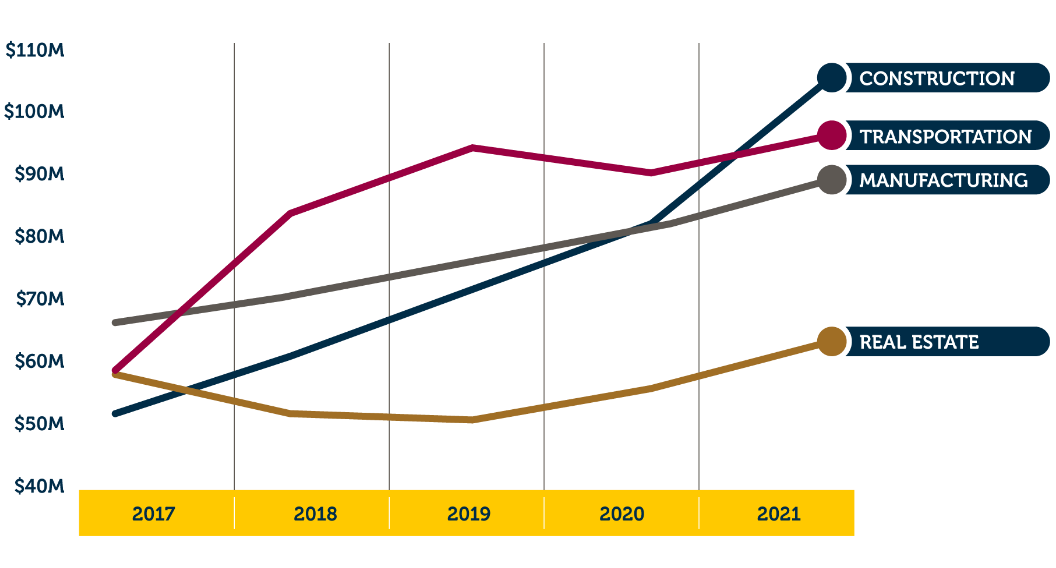

Last year, Central went all-in on aligning with our agency partners. And, the results speak for themselves. In commercial lines, new business grew steadily across each of our industry verticals with construction ending the year as our largest segment. In personal lines, we improved pricing and selection to achieve profitability.

Investments in developing world-class technology transformed the way we do business. Deeper levels of data continued to drive decisions around the ways we design and refine our products—positioning us to better serve our policyholders and deepening our relationships with those who matter most.

As always, we remain focused on growing in step with you, our agents, policyholders and key partners. Expect to see more exciting products and programs roll out throughout 2022, but rest assured this innovation comes without compromise. Excellence, hospitality and relationships will always be our primary focus. The trust you have placed in us inspired great things last year—and it will remain the core of a shared success story we’ll continue writing together in the years to come.

Evan Purmort

CEO & President