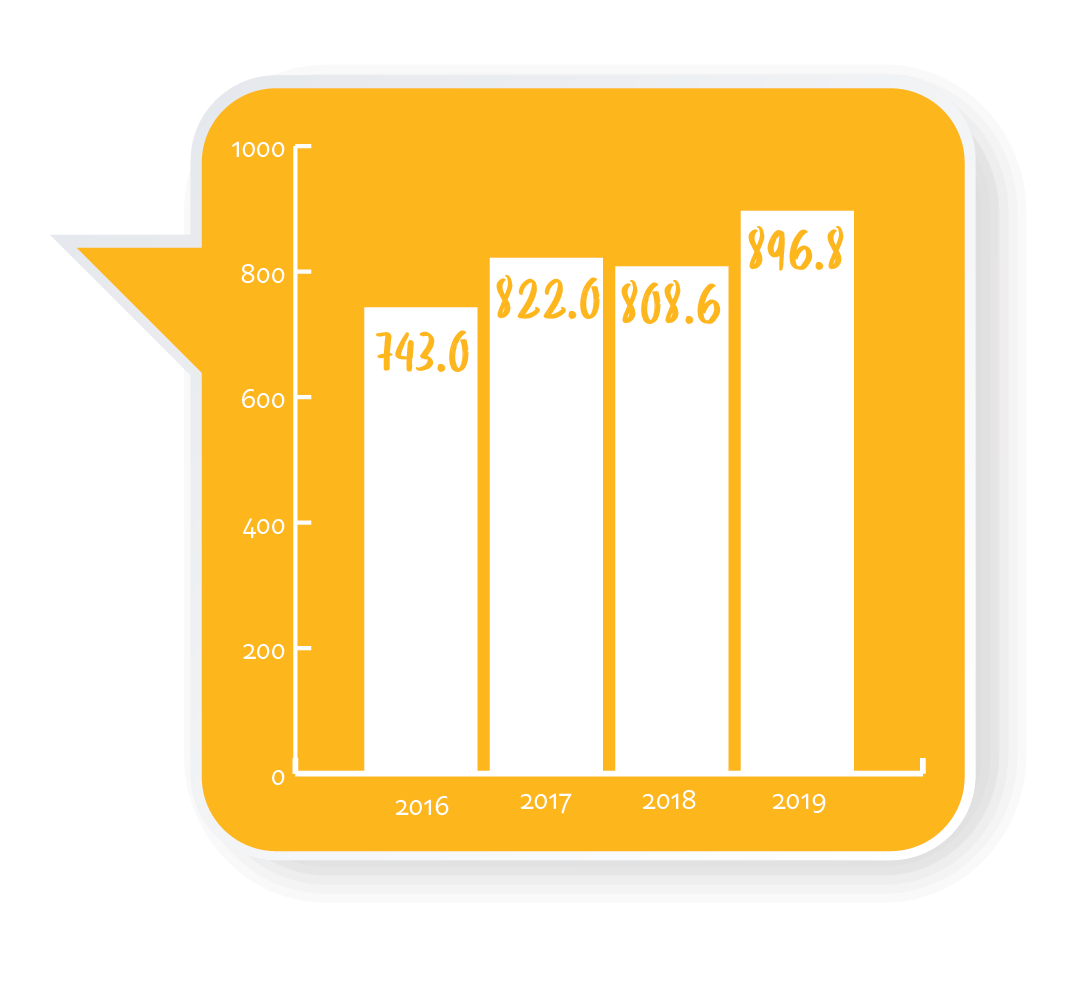

Central’s Policyholders’ Security Fund is an important measure of our ability to remain a consistent provider of insurance. As our Policyholders’ Security Fund increases over time, we continue to strengthen the financial foundation on which we can grow with our partners and deliver on the promise to our current customers as we have since 1876. Central’s Policyholders’ Security Fund has grown over 20% since 2016 and stood at an all-time high of $896 million at the conclusion of 2019. This level was achieved despite volatility in the industry and in capital markets during 2019, and reflects a very secure premium-to-surplus ratio of 0.80 to 1.00.

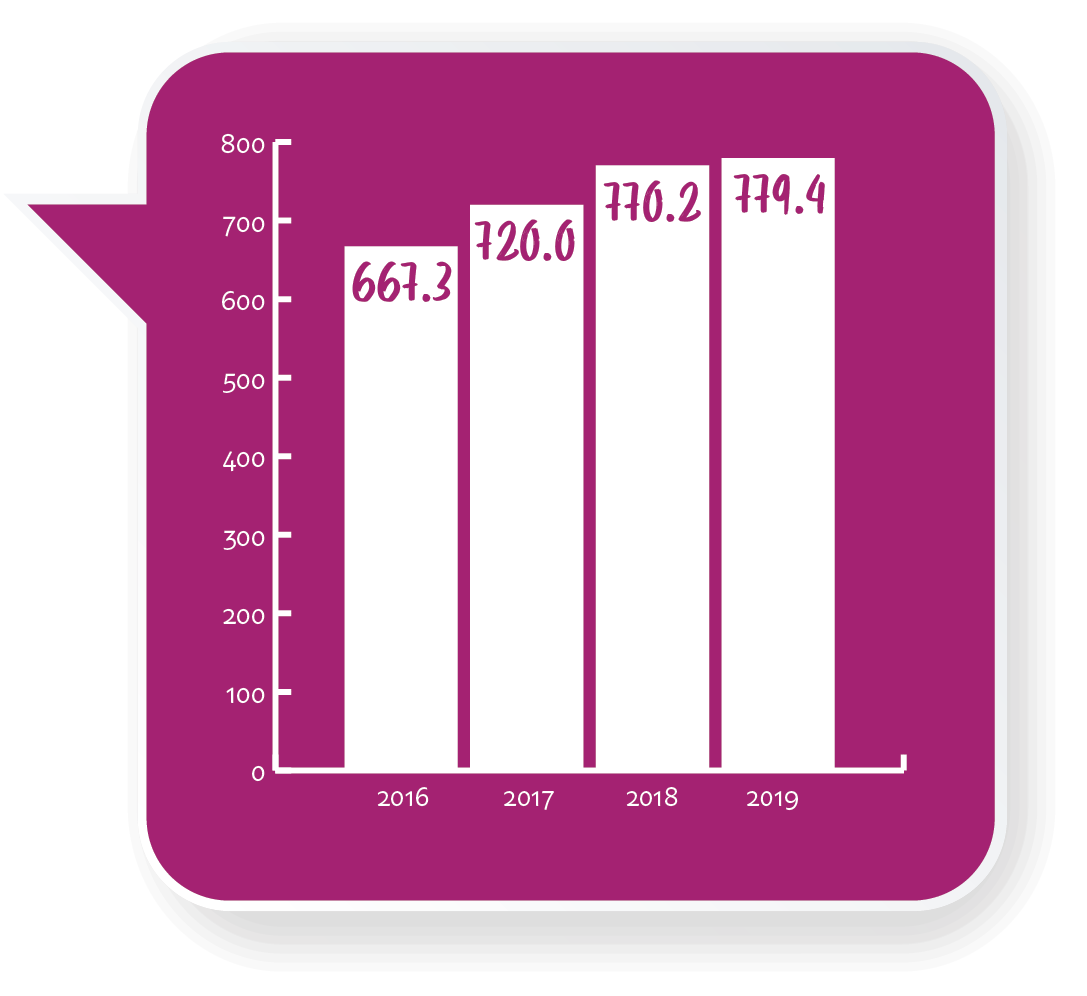

The consistency with which we have grown our Direct Written Premium represents the amount of promises we have made to our policyholders and our agent partners over time. Our growth in premium over the past four years has been strong and consistent, averaging 5.3% per year which has outpaced the growth of the industry.

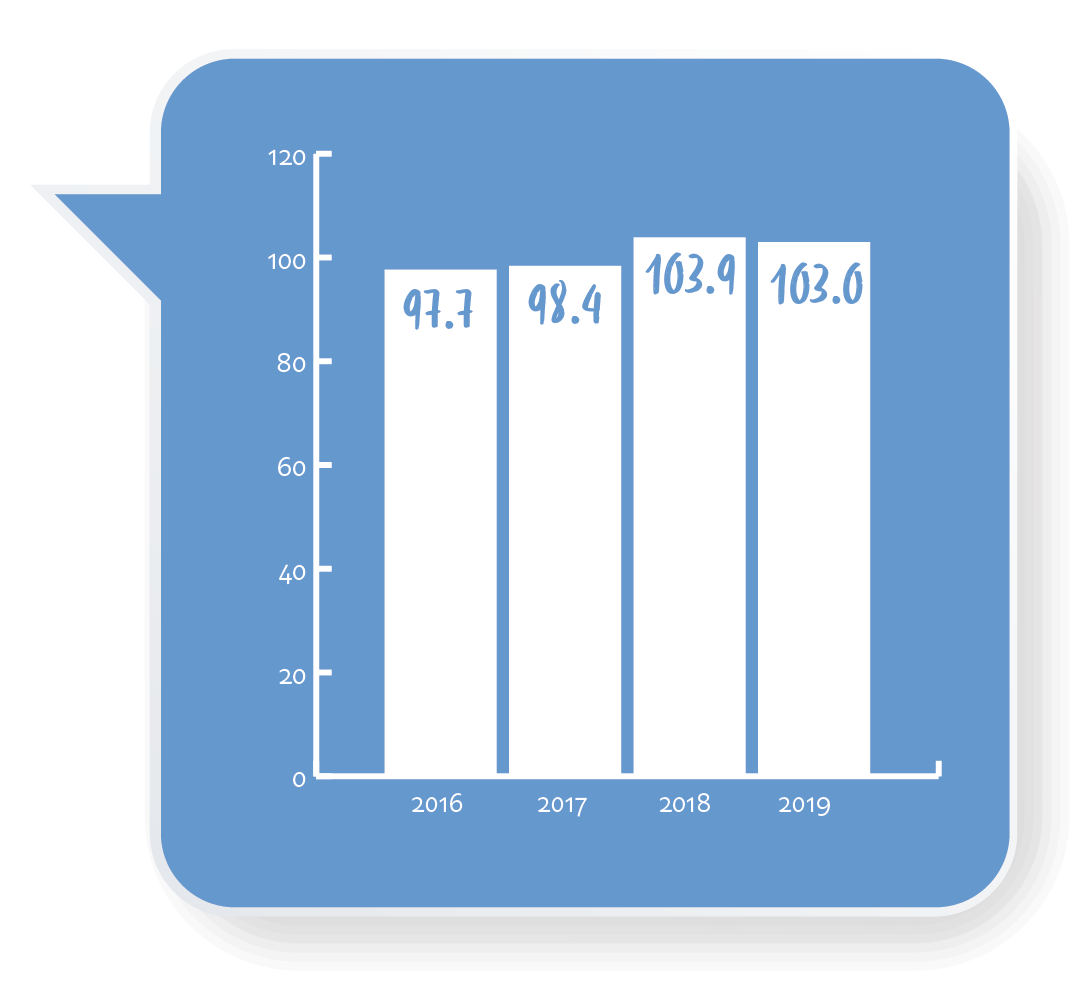

The lower the Combined Ratio is below 100, the more successful a company has been in managing its operations profitably. While Central has been a strong performer on Combined Ratio historically, 2019 continued to be impacted by adverse weather events from 2017 and 2018, and also from pressure in the commercial auto product line.

|

Central Mutual and All America Insurance Companies ('Central') Summarized Balance Sheet as of 12/31/19 |

|

| ASSETS | CENTRAL |

| Bonds | $1,097,228,266 |

| Stocks | 373,086,259 |

| Real Estate | 38,669,561 |

| Cash & Short-Term Investments | 105,364,017 |

| Agents' Balances & Uncollected Premiums | 232,449,781 |

| All Other Assets | 83,486,406 |

| Total Admitted Assets | $1,930,284,290 |

| LIABILITIES & POLICYHOLDERS' SECURITY FUND | |

| Losses & Loss Adjusting Expenses | $536,948,738 |

| Unearned Premiums | 381,501,835 |

| Commissions Payable & Contingent Commissions | 20,136,129 |

| Ceded Reinsurance Premiums Payable | 6,603,035 |

| Taxes and Other Liabilities | 88,246,230 |

| Unassigned Funds (Policyholders' Security Fund) | 896,848,323 |

| Total Liabilities & Policyholders' Security Fund | $1,930,284,290 |

| SELECT PERFORMANCE MEASURES | |

| Total Central Assets | $1,930,284,290 |

| Direct Written Premium | $779,368,324 |

| Growth Rate in Direct Written Premium | 1.2% |

| Combined Ratio – Central Companies | 103.0% |

| Policyholders' Security Fund | $896,848,323 |

| Premium to Policyholders' Security Fund Ratio | 0.80 |

| A.M. Best Rating | A (Excellent) |

This information is not intended to supercede, or be as comprehensive as, the statutory annual statement filed for each company with the appropriate state insurance departments. The statutory financial statements of Central Mutual Insurance Company and Consolidated Subsidiaries have been audited by Plante & Moran, PLLC. Complete copies of the statutory financial statements have been filed with the appropriate state insurance departments and are also on file at the Home Office of the Central Insurance Companies in Van Wert, Ohio.